Securing home financing is a significant milestone a number of people's lifetime, offering not only financial support and also paving the way in which into getting an item of a residential property. Contained in this context, learning to carry out and you can remark your residence mortgage will get vital. The brand new ICICI Bank Financial Statement is actually a crucial file into the it journey, delivering a thorough report on the loan info, fees background, and you may leftover balance. They functions as an economic ledger for your home financing, recording every deal ranging from you and the bank about your loan.

Being able to access and looking at their ICICI Bank Home loan Declaration sometimes was essential energetic mortgage management. It permits one to track the payment improvements, choose people discrepancies very early, and implies that youre constantly alert to debt obligations. This article will demystify the entire process of downloading the ICICI Financial Report, making it obtainable and straightforward per homeowner. Regardless if you are tech-smart or choose antique strategies, this guide talks about each step to make certain you can access their loan statement effortlessly.

Understanding the ICICI Financial Report

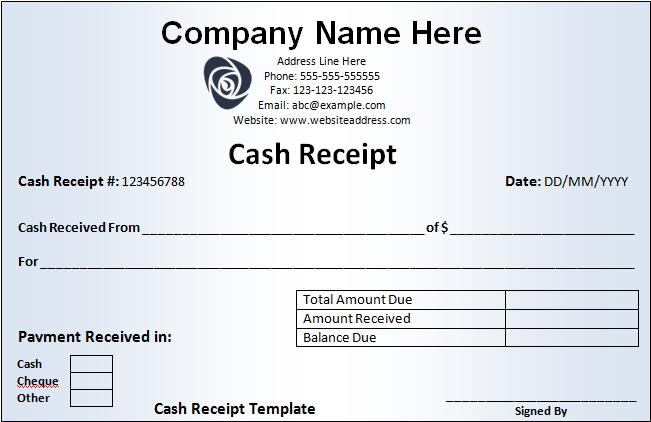

- Recommendations of debtor and mortgage membership

- Latest a good mortgage amount

- Appropriate home loan interest (fixed/floating)

- Amount of for every single EMI paid down

- Report about prominent and you will interest count when you look at the monetary season

- Specifics of part commission (or no)

- Home loan matter repaid till date.

Importance and Uses off ICICI Bank Financial Declaration

The latest report isn't just tabs on purchases; its a critical document for economic believed and mortgage government. It assists you probably know how much of the loan is paid of and just how far is still due, letting personal installment loans in Memphis you bundle your finances greatest.

Making clear Your loan Reputation and Economic Considered

There are numerous issues should think about prior to investing in actual estate like What are finest upwards finance? What's Wise Ownership from inside the A house? What does step 1 RK household mode?

One bottom line that always need to be assessed is your house mortgage report. Continuously looking at their ICICI Home loan Declaration is notably impression your own financial considered. It describes the loan status, appearing the loan payment advances. This post is critical for planning your finances, since it can help you determine how far money you could allocate with other expenses or discounts. In addition implies that you are on track together with your financing money, to stop people surprises in the future.

ICICI Mortgage Notice Certificate: A crucial Product to own Tax Protecting

The latest ICICI Financial Focus Certificate is another critical document getting property owners. It facts the interest percentage of your loan repayments along the economic year, that is very important to saying taxation write-offs below Part 24 off the cash Income tax Act.

Simple tips to Leverage Your loan for Income tax Positives

Tax professionals represent among advantages of financial. Teaching themselves to control such professionals is vital to enhancing your discounts when you are paying the loan. With the ICICI Home loan Focus Certification, you could effortlessly decrease your nonexempt money by the claiming write-offs toward the eye paid back on your home loan. So it just assists with saving fees and in addition within the dealing with your money more efficiently.

Unveiling the procedure of ICICI Bank Home loan Statement Download

To start downloading the ICICI Mortgage Declaration, make sure you have your financial information useful. Which first step is not difficult however, crucial for opening the loan declaration easily and you can properly.

Of these looking at selection along with other finance companies, learning how to install the newest HDFC Financial On the internet Declaration normally offer understanding to your processes.