Subprime Loan providers and Rates

When you're struggling to be eligible for an FHA otherwise Virtual assistant financing, you can even believe dealing with good subprime financial. Subprime lenders focus on handling those with bad credit and may also manage to present that loan that have good high interest.

In advance of agreeing so you can a loan, make sure you understand the fine print as well as how much the loan will cost you through the years.

In conclusion, there are several loan options available to people that have poor credit that happen to be looking to purchase a mobile domestic. From the exploring the choices and working with a reliable bank, there are a loan that meets your needs and you can finances.

If you have less than perfect credit, you may need to pay a high interest on the mobile home loan. But not, you might nevertheless be eligible for that loan which have a downpayment and you may an effective financing conditions. Here are some facts to consider when figuring your deposit and facts loan fine print.

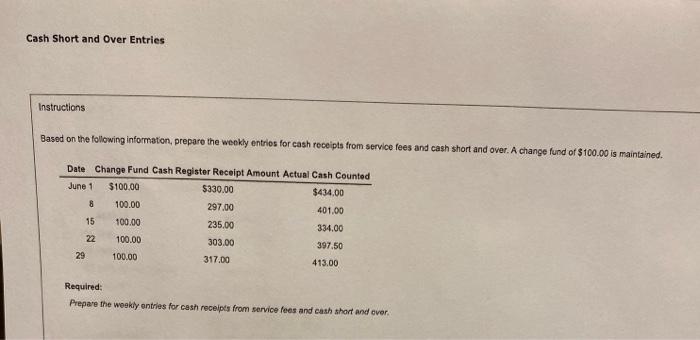

Figuring Down payment

If you have bad credit, you might have to build a more impressive deposit to help you meet the requirements for a loan. Extremely loan providers wanted a downpayment of five% so you're able to ten% of your own loan amount, however some may require to 20%. You can utilize on line calculators to help you estimate your down-payment based for the cost of the fresh new cellular house plus credit rating.

Facts Mortgage Fine print

Mortgage fine print can differ with respect to the lender, even so they fundamentally range from the amount borrowed, interest rate, and loan identity. The mortgage count is the overall sum of money your use, as the rate of interest is the part of the loan matter you pay in the attention annually. The loan title 's the length of time you have got to pay the loan.

When you have less than perfect credit, you may have to deal with smaller positive loan conditions and terms. Although not, you might however shop around to possess lenders to find the best mortgage for your state. See loan providers you to definitely concentrate on mobile mortgage brokers or bring fund to help you borrowers with less than perfect credit or a low credit history.

Just West Virginia payday loans remember that , a cellular mortgage is a protected mortgage, meaning that the brand new mobile house functions as equity into loan. For those who standard to the financing, the lending company can be repossess brand new cellular home. Be sure to see the mortgage fine print before signing that loan contract.

By the figuring your deposit and you will expertise loan fine print, you could potentially boost your chances of bringing accepted to possess a mobile home loan that have less than perfect credit.

Finding the optimum Lender

For those who have bad credit, finding the right lender for your cellular a mortgage will be a challenge. But not, it is not hopeless. Here are some tips in order to find the appropriate lender:

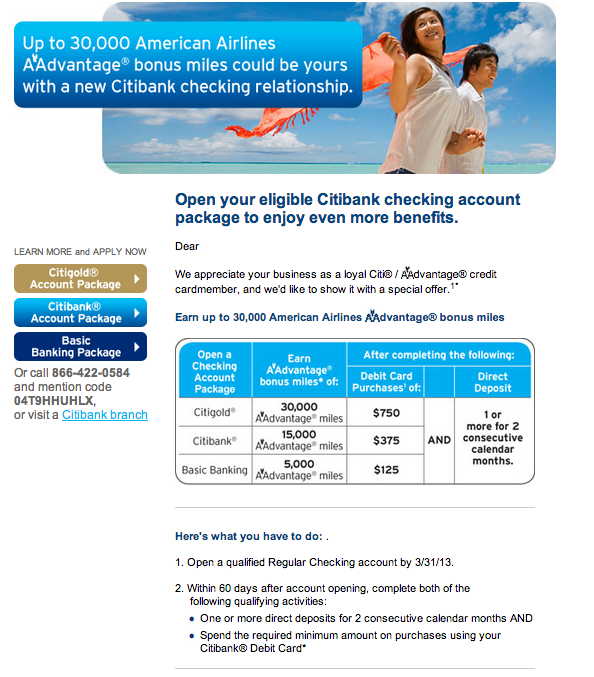

Contrasting Lenders and Mortgage Also provides

It is important to shop around and you may examine loan providers and you may loan even offers before deciding. Pick lenders whom specialize in mobile a mortgage and also experience coping with consumers with bad credit. You need to use online language resources evaluate lenders and you may mortgage now offers otherwise work with a large financial company who will support you in finding an informed alternatives.

When you compare loan even offers, seriously consider the rate, fees, and you can installment conditions. Definitely understand the total cost of one's financing and you may simply how much you might be using monthly. Do not be frightened to inquire of issues or discuss words for individuals who feel just like you aren't bringing a fair offer.