Interest-Only Mortgage loans

While the borrower will only end up being paying rates of interest repayments, as opposed to dominant costs, the fresh new month-to-month mortgage repayments become more down. Although not, as long as the principal is not being reduced, the newest debtor usually still owe the same sum of money at the end of the loan title. Interest-just mortgages is just be put just like the a temporary size while the new borrower enhances its income and you may will pay down personal debt.

Brand new Subprime Financial Crisis

The word subprime mortgage includes an embarrassing and on occasion even bad meaning on account of brand new subprime home loan drama in america.

This new You.S. property bubble, together with eventual , was mostly triggered due to subprime mortgage loans. The main cause is actually the ease one financial institutions borrowed aside mortgages so you can subprime borrowers, even to the people exactly who couldn't afford or match their mortgage repayments. That is because banking companies and you will hedge funds included these types of subprime mortgage loans into the mortgage-recognized securities (MBS), which have been insured that have credit standard exchanges (CDS), right after which sold out over traders.

All of these subprime mortgages had been changeable-speed mortgages (ARMs), which had reasonable 1st interest rates who later on reset at the higher levels, tend to leading to consumers to help you standard as they are only able to pay the first low rate.

The most popular subprime variable-speed mortgage (ARM) try the two/twenty eight Arm, the spot where the first two many years of the borrowed funds provides a very lower "teaser" rate that is repaired, since the left 28 years of new 29 season amortization is actually from the a varying interest, which is a lot loan places Superior higher. Drawn when you look at the of the initially lower intro rates, only to getting economically crippled of the higher interest rates afterwards, try the cornerstone of your subprime business model.

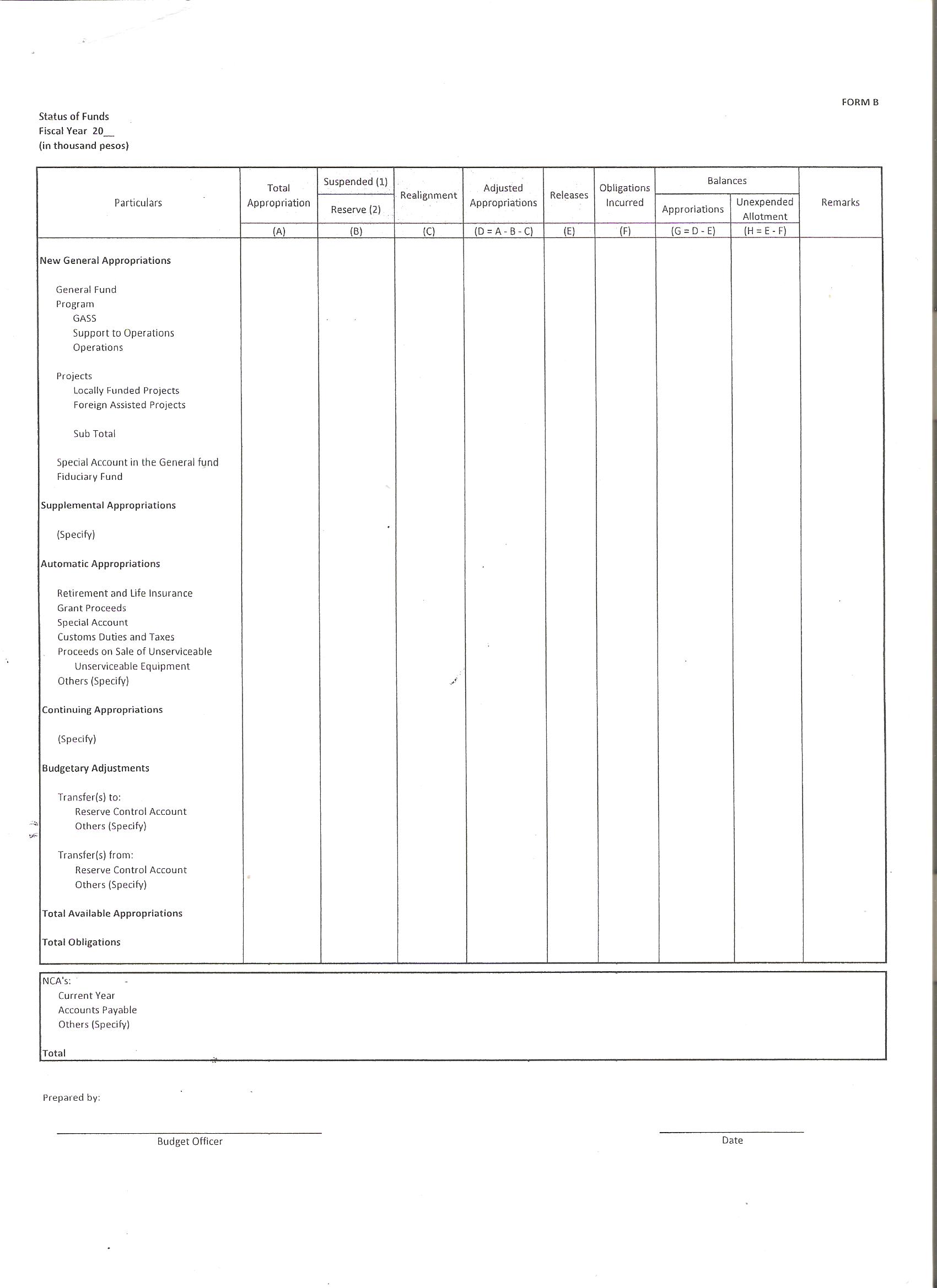

The latest desk below compares initially "teaser" subprime financial prices offered in the united states off 2004 so you can 2007 on complete varying price you to definitely individuals manage face just after that it promotion period. The latest intro cost varied of 7% to eight%, and the full variable rates ranged of 9% so you can eleven%, each other higher than the top costs given. Although this difference between the new teaser speed and blog post-intro price may seem small, it got significant effects into the financially unpredictable domiciles.

Subprime Home loan Rates: Intro Rates and you can Fingers

The problem is made worse from the fact that of several lenders did maybe not securely vet borrowers' capability to pay back this new money, right after which used the arises from MBS conversion process to help you traders in order to provide out way more subprime fund.

Popular having home loan-backed securities motivated finance companies so you're able to flake out credit criteria trying to help you fill so it consult, and that ran as far as credit out mortgage loans to individuals which have no income, zero occupations, with no property - known as NINJA mortgages.

Exactly how Popular Was basically Subprime Mortgage loans?

Subprime mortgages composed nearly a third of all financial originations when you look at the 2005, having 23.6% of all mortgages began of the financial institutions in 2005 becoming a great subprime home loan. Which figure try highest to other financial institutions, where subprime mortgages made up 41.5% of their began mortgage loans. Credit unions got a good muted part on the subprime financial world, with only step three.6% out-of borrowing connection mortgage loans are subprime. Following the overall economy, subprime financial originations became a whole lot more limited.

Subprime Mortgage Originations (% away from Mortgages)

The fresh new prevalence regarding subprime mortgages including depended to the part and you can possessions method of. Including, 14.8% of all of the residential property bought in Massachusetts into the 2005 was purchased playing with subprime mortgage loans. Yet not, thirty two.6% of all the multiple-home purchases was in fact having a beneficial subprime mortgage, but only thirteen.2% off solitary-family home instructions was which have an excellent subprime home loan.

Subprime versus Best Fico scores

To reduce their DTI, you can either run increasing your money otherwise decreasing your expenses. If you're not capable of sometimes of those one thing, there was however guarantee - and that is where subprime mortgages come in. Subprime mortgage loans get allow it to be a max total debt service (TDS) proportion as high as fifty%, however some personal loan providers might not have a maximum limit from the every!