Fold Credit System Assessment

The brand new Bend Credit System when you look at the Oregon is an important capital to own low- in order to average-earnings homeowners. It might hide so you can 100% of one's bucks had a need to intimate towards the property, also deposit, closing costs, and related expenditures. Prospective people is also find out more about the fresh new program's qualification standards, investment solutions, and you can app procedure from OHCS web site.

System Qualifications, Capital, and Experts

Oregon's Bend Credit Program broadens homeownership solutions for family from the condition. Geared to lower- to help you moderate-income domiciles, it gives down-payment assist with qualified homeowners. Applicants need to fulfill income limitations tied to household dimensions plus the property's destination to be considered. Such as, consumers need to earn $125,000 otherwise shorter a-year and never individual any a property on closure. Simultaneously, they must done an effective homebuyer knowledge movement.

The latest Bend Lending Program really works in collaboration with recognized lenders to facilitate the process of to acquire property, so it is way more obtainable getting Oregonians trying reach homeownership. The program can cover-up to 100% of cash expected to close on the property purchase, like the deposit, closing costs, or any other relevant costs.

Software Processes

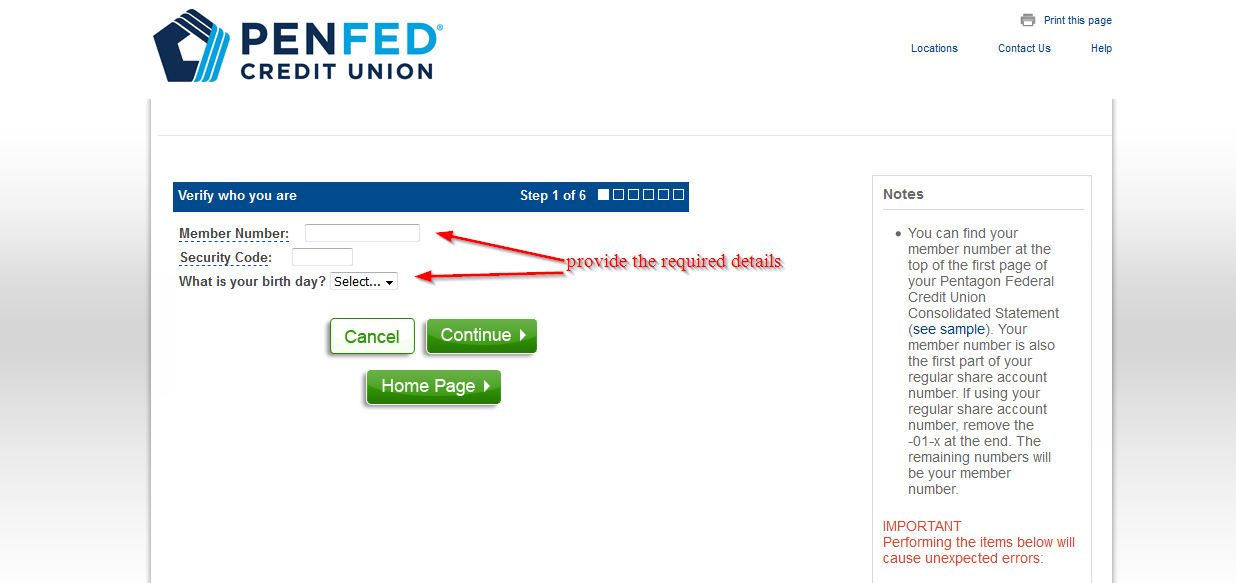

Included in the software procedure to your Oregon Flex Credit Program, individuals will need to bring monetary documentation to confirm its money and you will assets. This post is used to determine qualifications together with complete count regarding finance provided.

Curious candidates can also be contact accepted lenders such as Sierra Pacific Home loan and you will Arizona Trust Bank for additional info on eligibility and requirements having new Fold Credit Program. Such teams offer details about the newest program's access and you may certain requirements, assisting the application techniques.

Local Homebuyer Assistance Solutions

Regional homebuyer recommendations alternatives for the Oregon include a range of programs and you will resources customized to support basic-date buyers. Concurrently, the company provides Cash Virtue and you will Rates Advantage apps to greatly help potential customers browse down payment and you can capital possibilities.

Local DPA programs after that help the assistance https://paydayloanalabama.com/winfield/ available to potential homeowners inside the Oregon. This type of applications make an effort to connection the fresh gap involving the economic conditions of buying a property and tips offered to first-day customers. From the handling secret monetary traps, these types of attempts enable more individuals to know its dreams of homeownership.

Furthermore, the original-Big date Domestic Consumer Bank account, provided by the brand new Oregon Company out-of Cash, gift ideas an alternative opportunity for men and women to save getting off costs in a taxation-advantaged manner. Which effort underscores the newest nation's dedication to cultivating a supporting environment for basic-go out homeowners.

Oregon Houses and you can Neighborhood Characteristics offers very first-date household customer provides to alleviate financial barriers getting qualified people. This type of offers give deposit and you can closure cost assistance to assist create homeownership a whole lot more achievable.

The fresh new gives off OHCS target the new upfront costs that can easily be challenging for some basic-time homebuyers. As a result of such offers, eligible someone can discovered very important financial assistance that can create an effective significant difference within power to manage an alternative domestic. Financial assistance start from income tax-advantaged savings through a primary-Time Household Client Bank account offered by the new nation's Company away from Revenue.

City-Certain Property Suggestions

About real estate during the certain towns inside Oregon, mediocre home prices and corresponding down costs are different somewhat.For this reason it's important to assemble area-particular advice prior to people conclusion from home buying in the Oregon.

House when you look at the Portland, along with semi-affixed townhomes and you may detached unmarried-loved ones homes, . Normally, choice listed on the market, plus several- and you can three-room residential property, may vary from $300,000 and you will $900,000. According to a house worth of $529,900, the newest deposit could well be $fifteen,897 having step 3% or $105,980 having 20%. In addition, Portland brings a downpayment advice loan program that gives up so you can $80,000 along the urban area or $100,000 within the focused elements.