The latest personal bankruptcy automated remain stop an effective pending property foreclosure income very enough time as you have perhaps not got a past personal bankruptcy situation dismissed within the past 12 months. Sometimes individuals have so you can dismiss and re-file bankruptcies to resolve activities in regards to their houses and other activities. If the folks have multiple active situation in the year prior to submitting the present instance, there isn't any automatic sit and things getting far more difficult. A professional bankruptcy proceeding lawyer is also brainstorm the choices with you including actions fast payday loan Slocomb Alabama to help you instate the newest automated stand.

Removing Next Mortgages, HELOCS Another type of LIENS

As well as ending a foreclosure sale of your property, Section 13 also allows you to beat certain view liens against your house in some instances and under-protected mortgages or deeds off faith. There are various additional options in Chapter thirteen to have removing particular home loan liens (both fully reducing junior liens) into both dominating residences and other features.

What is actually Foreclosures?

Foreclosure are something in which a lending company/resident usually takes back home in the event that consumers stop and come up with money on their home loans and you will are not able to just be sure to get stuck upwards otherwise care for the issue from arrears into financial.

UTAH Property foreclosure Procedure

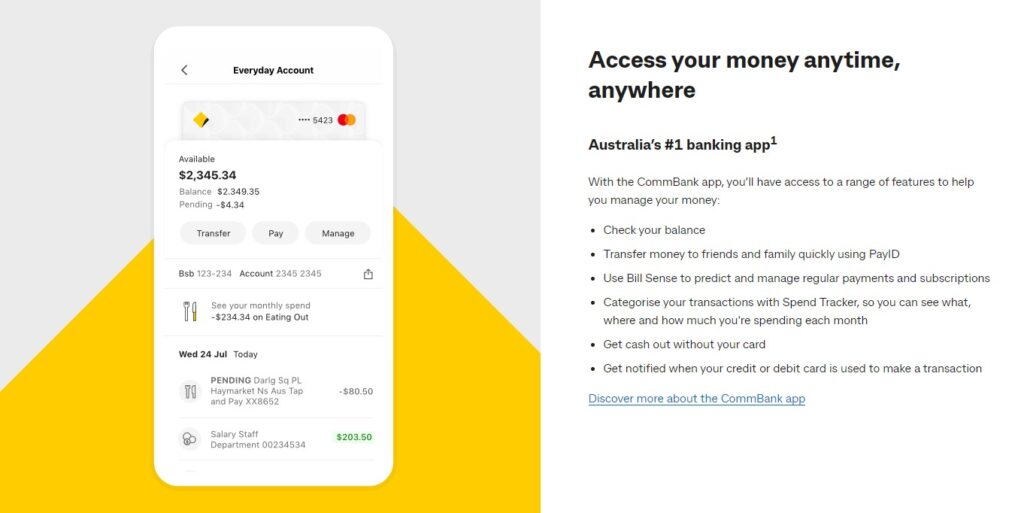

Less than Utah law, a home bank carrying a deed of Believe recorded facing a Debtor's household can complete property foreclosure legal proceeding inside in the 4 days once submitting the right find. The fresh submitting out of a chapter thirteen case comes to an end a property foreclosure purchases instantly through to submitting. For people who hold back until following the foreclosures sales enjoys occurred, it is often impossible to opposite new foreclosure as well as your domestic is missing. Whenever you located notice that the lending company intentions to initiate the foreclose processes, immediately talk to a legal professional

Those people who have a great amount of loans and so are considering debt consolidating because of the credit up against their homes is to as an alternative seriously consider bankruptcy solutions to them lower than Sections seven and you may thirteen. Taking on a lot of time-term indebtedness up against an enthusiastic individuals' first household have a tendency to results in an excessive amount of high repayments that people is generally struggling to experience over along the loan. When your individuals are obligated to bear most loans immediately after credit against their houses, or if perhaps they can't obtain sufficient financing up against their belongings so you can consolidate each of their obligations, he could be at risk of shedding their homes abreast of people change in the finances. Sections eight and you will 13 often permits people to release a large amount out of consumer debt and also out of unappealing and unwelcome covered debt.

HOMESTEAD Exemption Covers A great number of Equity

The Homestead Regulations regarding County of Utah have been revised during the 2008 and are also really good so you can bankruptcy Debtors. The current Homestead Different to possess a first house is $29, for each individual and you will $60, for each pair. There are numerous cutting-edge nuances and you will info with the Homestead Exemption you ought to data and you can discuss with a legal professional. Instead of borrowing facing their homes, Debtors that newest from inside the costs towards the the money facing their domestic, is also document Chapter 7 case of bankruptcy, eradicate most of their other financial obligation, and emerge from A bankruptcy proceeding to the guarantee within belongings undamaged by the stating around $29, in order to $60, of your own equity in their homes excused. If you are ineligible to possess A bankruptcy proceeding, Chapter thirteen choices are just as glamorous.

In case the Debtors' family collateral exceeds new limitations of Homestead explained more than, a part seven option was going to never be liked by them as their property would be pulled and sold by Case of bankruptcy Trustee. Debtors having guarantee exceeding $30,000 each personal otherwise $60,000 per pair, or one equity maybe not protected by the new Homestead Difference should consider submitting Part thirteen to resolve their financial difficulties.