James Chen, CMT was a specialist buyer, capital adviser, and you may internationally markets strategist. He's got composed courses into technical studies and you may forex written by John Wiley and Sons and you can supported because the a guest specialist on the CNBC, BloombergTV, Forbes, and Reuters among almost every other economic mass media.

Knowledge Very first-Date Homebuyers

As stated significantly more than, a primary-big date homebuyer can be an individual who sales a property to own the very first time. So it home is considered the fresh new homebuyer's dominating household-the primary area that any particular one inhabits.

It may also end up being called their top home otherwise head quarters. Keep in mind, even when, one to a main household may well not always be an authentic house. As an example, it can be a boat that a person lives towards complete-go out.

The newest U.S. Company from Casing and you may Urban Development (HUD) expands one definition even more. Depending on the department, a first-time homebuyer try:

- An individual who has not yet owned a main home to the around three-season period conclude with the day of purchase of brand new domestic.

- An individual who has not possessed a primary residence though their partner are a homeowner.

- Anybody who is an individual father or mother exactly who possessed property which have the ex-spouse.

- A great displaced homemaker who only possessed possessions along with their mate.

An individual who merely had possessions one to was not for the conformity that have and should not getting lead for the conformity which have regional or county building requirements in the place of creating another permanent structure.

First-Go out Homebuyer Guidance

First-day homeowners which get into any of the significantly more than groups will get qualify for specific government-sponsored programs that can offer financial assistance.

Government Homes Administration (FHA) Finance

The newest Government Homes Government assures this type of mortgage exists of the FHA-accepted lenders. The fresh agency's support has the benefit of loan providers a sheet out-of defense, so they would not sense a loss of profits in case your borrower non-payments. FHA finance keeps aggressive interest levels, faster off repayments, and lower settlement costs than just traditional funds.

You.S. Company out of Agriculture (USDA)

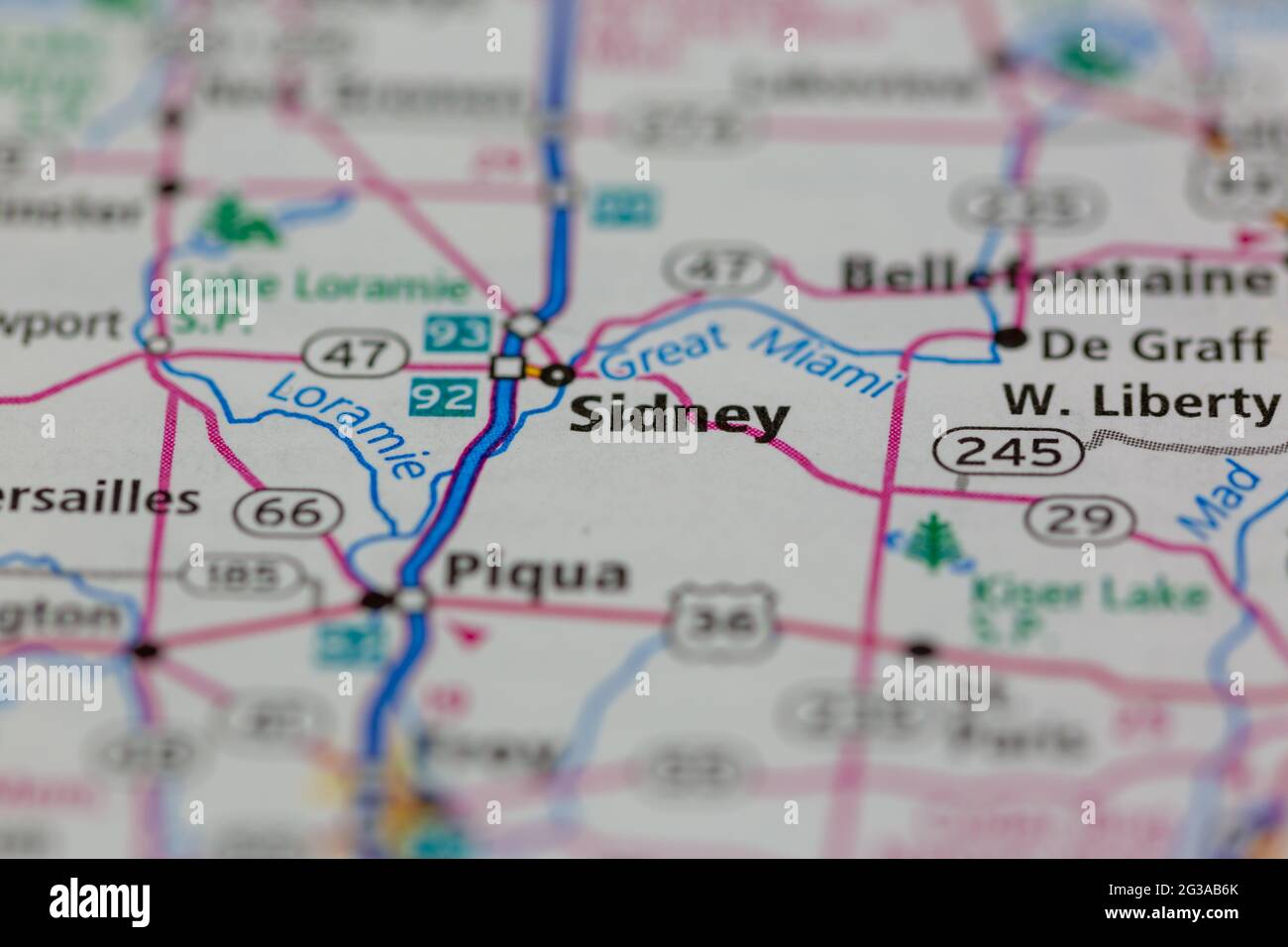

The brand new U.S. Company from Agriculture's homebuyer guidelines system targets residential property in some rural section. The newest department guarantees the home mortgage, there are no down-payment necessary. Concurrently, the loan repayments try repaired.

U.S. Institution from Experts Things (VA)

The brand new U.S. Agencies off Experts Activities support first-time homeowners who will be energetic-obligation military people, pros, and you may thriving spouses. Virtual assistant finance bring competitive interest rates, need no deposit, therefore the Va pledges the main mortgage.

Having good Virtual assistant loan, first-date homeowners aren't expected to purchase individual financial attract (PMI), plus they don't need to manage the very least credit rating to have qualification. Incase new borrower ever cannot make payments toward financial, the fresh Virtual assistant is also discuss on the bank on their behalf.

Lender-Considering Advantages

Just like the detailed more than, certain lenders bring basic-day homeowners having specific perks particularly special funds. Such as, first-big date homeowners having lowest- so you can modest-income levels may be eligible for grants or loans that don't want fees for as long as brand new debtor stays home having a particular period of time.

Closing costs direction can certainly be open to specific people depending to their items. Many of these choices are provided owing to authorities-backed apps. Eligibility may differ based on homebuyers' credit scores, earnings membership, and you can local requirements.

If you believe you've been discriminated facing because of the a lending company predicated on battle, faith, intercourse, relationship condition, usage of societal recommendations, federal origin, handicap, otherwise many years, you could potentially file a report on Consumer Financial Safeguards Bureau or HUD.

Special Considerations

An initial-date homebuyer is able to withdraw from their individual old age membership (IRA) as in loans credit disability opposed to running into the first-shipments punishment, and this pertains to IRA withdrawals one occur before IRA holder has reached 59.5 years old.

The acquisition does not need to feel a classic home getting the individual to meet the requirements since a primary-date homebuyer, nevertheless must be the dominating household. Such, it can be an excellent houseboat you want to use once the your primary residence.

The maximum amount which is often marketed from the IRA towards the a punishment-totally free basis for so it goal is $10,one hundred thousand. This is certainly a lifestyle limit. To have married couples, the limit is applicable alone to each and every mate. As a result the latest shared limitation for a married couple was $20,000.